The Power of Connection Among Cities: An Interview with Parag Khanna

Blueprint |

By Tony Sheehan

Cities are the canvas for where we live, work, shop and play. But how important are they? According to economist Parag Khanna, very important. In fact, he believes that “sustainable urbanization is mankind’s No. 1 priority in the 21st century.” It is a bold statement, but if anyone truly understands the importance of cities around the world, he does.

For the last several years, he has traveled to more than 50 countries exploring the very fabric of cities to understand how they are changing and, more importantly, how they are all connected. He recently published his third book in a trilogy on the future of global civilization, titled Connectography. The book explores how the world is now being shaped less by what separates us—borders and cultural differences—and more by what connects us—global infrastructure, supply chain routes and telecommunications.

While we may traditionally think of connectedness as a matter of fiber optics and wireless networks, sustainable connection starts at a more basic infrastructure level. Though Internet connection is important, it’s infrastructure such as roads and pipelines that are the foundation of connected and competitive cities.

The good news is that a world with the city unit at its center can break down borders, as connected infrastructure allows them to better collaborate and share resources.

Blueprint, presented by CBRE, recently had the chance to sit down and speak with Khanna about his views on the future of civilization, and why cities will be at the heart of our growth.

WHAT WAS THE INSPIRATION BEHIND CONNECTOGRAPHY?

Connectography is actually the completion of a trilogy. It started with The Second World, and that was my tour of geopolitics. It was a ground-eye view where I traveled to 45 countries for about two and a half years. I looked at how emerging markets are competing with each other, and how they are leveraging globalization to gain geopolitical advantage. The book was focused entirely on these middle-tier, high-growth countries. That was the book where I said that you can judge the quality of the government by the quality of its roads. I started to use infrastructure as a proxy for a country’s pathway towards development.

The second volume was How to Run the World, and that was all about diplomacy and the need for companies and NGOs to be much more active in participating with governments solving global problems like development and so on.

Connectography is my third installment, which is a very futuristic book. It’s all about global connectivity. Many times we get stuck thinking about Internet connectivity as the main type of connection. But the first connectivity is transportation. The second connectivity is energy. The third, and the newest, is communications. It is important to bring it back to those basics—the basics that so many people forget. It can be tempting to say, “Hey, let’s leapfrog and invest in wireless infrastructure.” That’s great, but you still need a road. You still need heat. You need plumbing. I’m a huge advocate in looking to those Maslowian basics. And that’s what I’m interested in with this book. First the physical, then the digital.

Leapfrogging can have a tremendous positive impact. But I’m also a guy who drives around the world. And therefore, I don’t think you can substitute a phone for a road. You still need a road.

WHY SHOULD THE TYPICAL INVESTOR CARE ABOUT THESE CONNECTIONS THAT CITIES CAN MAKE?

It does something more than just help economic growth. It literally changes the nature of the system. It changes the nature of civilization. Our civilization is built on nations that border each other. I believe our world is going to become an intercity world, where cities are acquiring their own powers and authority. And a lot of that has to do with their connectivity.

In that sense, it is extremely relevant to many markets—including commercial real estate (CRE). Anyone who is trying to do an infrastructure deal typically wouldn’t go to the president of the country and ask for support. That’s not the way things work. You have to be in with the mayor and the local construction companies and the local banks. And in some places, even the warlords and the landlords.

This idea of devolution—the rise of local power—is a major driver today, a big factor for CRE developers and investors in land. Also, it is a big meta-theme on the asset side, because when you deploy capital based on projections based on national trajectories, you usually have it wrong. You have to be looking at the city level, so you need city-by-city data.

ARE THERE CITIES THAT ARE REALLY DOING IT RIGHT?

You have to look country by country. China is the gold standard here because they have invested in cities that no one has ever heard of that have really high-quality infrastructure. One of the things I do in my own academic work is look at Chinese investments to their third-tier cities—cities that most people have never heard of. You can look at government investment by geography and sector, and look at what cities are doing to rise up the value chain. And for every one of those cities, I guarantee you will hear about them five years from now based on what they are doing. If every country did that, it would be great.

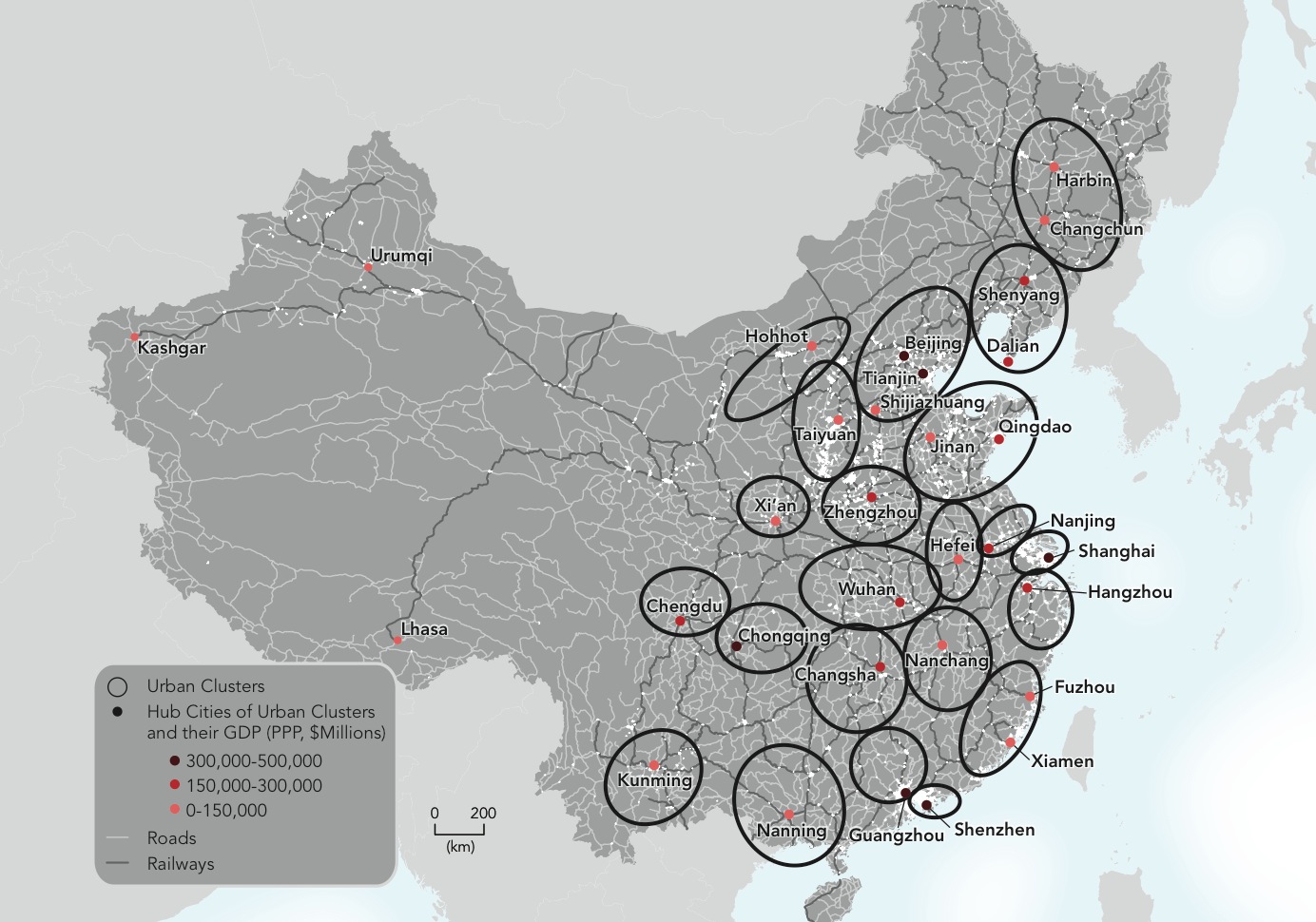

Urban clusters in China driven by third-tier cities.

Urban clusters in China driven by third-tier cities.

The United Arab Emirates is a small country where you can see this happening in some of its smaller cities, and you can see where the support is going. Similarly, you can see it in Colombia making an investment in non-Bogotá cities. Smaller cities are getting a lot more public investment.

India is now trying to do this with the 100 cities involved in the Smart Cities campaign. They have made it a very international and multi-stakeholder approach where they have paired cities with certain management consulting firms or infrastructure advisory firms. They want to accelerate urban development right now, which I think is a winning approach.

The new trend now is not building new cities. That was the popular approach for many years, but we have turned away from that now. Today, the focus is on reforming existing cities. That’s messier, and it can mean dealing with a lot of corruption and red tape, but most importantly, it can impact more people’s lives.

WHAT DETERMINES WHETHER A CITY WILL SUCCEED OR FAIL FROM A SUSTAINABLE GROWTH PERSPECTIVE?

The question we ask is whether a city can survive what I call the “triple whammy:” rising U.S. interest rates, slowing Chinese growth and permanently low commodities prices. So the question is, which countries of the emerging markets survive this triple whammy?

One thing for sure is that the oil exporters have to tighten their belts. Everyone knows that. My argument, though, is that not all emerging markets are hurt by low oil prices. Some of the most important countries in the world benefit from cheap oil because they can invest the savings into infrastructure. Cities in India and Pakistan and Indonesia and Kenya may look to benefit.

SHOULD WE LOOK AT COMMUNICATIONS AS A COMMODITY IN THE SAME WAY WE DO ENERGY?

Absolutely. Data centers are an asset class. Investing in fiber or private provision of a high-speed Internet has significant payoffs in a microeconomic environment. We have microeconomic studies on the local GDP when they increase the bandwidth. What we see is that it doesn’t matter whether the investment is private or public, and it has an impact. I recently published a survey of the improvements that second-tier cities derived from improved Internet connectivity. So, absolutely, that makes it a valuable asset class.

ARE WE GOING TO HAVE MORE OR FEWER COUNTRIES AS CITIES BECOME STRONGER AND MORE CONNECTED?

One of the main points of Connectography is that as the need to be more connected increases, we will see more cities emerge in order to survive in a hyper-connected world. The way you get a totally connected world is by letting every city have its own autonomous status. But it really doesn’t matter since all of these cities and countries are connected. Eventually we will stop focusing on how many countries there are, and instead let them do what they want.

DO MORE COUNTRIES LEAD TO MORE POLITICAL BATTLES?

You know, what starts to happen is that you have a convergence about how to run a place correctly. Cities, for example, have a standard playbook for how to run themselves correctly: how to collect the trash, how to have sewage, how to provide Wi-Fi in public places, and so on. Mayors know how to do this; it just makes sense to them.

I’ve run these correlations around quality of governance in large vs. small countries, and it turns out the least corrupt countries in the world are almost all small countries, with small geographic area and small populations. The exception is Canada, which is large but doesn’t have much corruption.

DOES CONNECTIVITY ALWAYS LEAD TO URBANIZATION?

That is a big debate right now. If you had full-scale connectivity, for example, in every barn in rural Congo or China, would people stop moving to cities? I’ve heard this argument from prominent social scientists. However, urbanization is not happening at a global level because people want faster Wi-Fi. They want jobs, they want doctors, they want education. Rural starvation is higher than urban starvation. You don’t grow food in cities; you develop markets in cities, and those markets are a more sustainable way to feed people consistently.

Better Internet connectivity is a fringe benefit of moving to cities, not the primary benefit. This is part of the problem with conflating digital connectivity as a panacea to solve the world’s problems. In reality, we still need to solve many more basic infrastructure needs to truly make lives better.

HOW DO WE TACKLE THE PROBLEM OF AFFORDABLE PUBLIC HOUSING?

What we are seeing around the U.S. right now—and we have been seeing around the world for a long time—is that you’re only able to produce equality [when you] build affordable public housing. Singapore is a unique case because there is universal public housing. Everyone owns property. It’s one of these quirks they developed in the 1950s, and now everyone has a place that they can call their own. It is an interesting public-private model—the best one in the world.

Many countries come to Singapore to figure out how to do it. The problem is that they’re too late. It’s hard to retrofit that policy onto existing countries. Singapore did it when it was born, basically, and they have just stuck with the policy.

However, if you look at the U.S. today, cities like Seattle are raising municipal taxes so that they can invest it in new construction of affordable housing. They have rezoned so they can build smaller micro-units that are cheaper to live in. You have people getting off of mom and dad’s couch and going out to move into their own apartments. They’re small, but that’s the way the world is these days. So Seattle adjusted quickly. Other cities have not adjusted as quickly.

You know that Seattle is going to reap the benefits of this policy 15 years from now because they have smart policies that aren’t going to change. They have bipartisan and state-level support for what they are doing.

WILL LABOR MOBILITY INCREASE IN A MORE CONNECTED WORLD?

Yes. In fact, there already is. If you look across the world, you see it happening organically through policy and design. Look at ASEAN (Association of Southeast Asian Nations), where they are very open about labor mobility, and as of last December [2015], they codified the ASEAN Economic Community and you have to have recognition of academic certificates from other countries and grant free migration from one country to the next. So if you work in one country and lose your job, you can easily move to the next and find another job. There are huge benefits to economies where they have more free migration policies.

It’s very well proven that more migration is basically always good. No question about it.

WHAT IS YOUR FAVORITE CITY?

I had not been to Vietnam in 10 years, and just visited Ho Chi Minh City recently, and it was amazing. For a city that is projected to have 25 million people, it is so orderly, well-functioning, very green, very impressive. To see such a beautiful city from a country that is rising so fast is great to see. I see it as a great model for how to build or rebuild a city.

I live in Singapore, and it is a tropical urban paradise. It’s hard to beat. For 20 years, I was a New York-London guy. New York-London was the global axis of leadership. Now I live on what people call the “New Maritime Silk Road” which is Dubai-Singapore. And all of the growth in world trade in the last 10 years has come from the Indian Ocean region, from the Suez Canal to the Strait of Malacca. So that’s the new axis, and I find myself shuttling between these cities a lot. Dubai-Singapore is the New York-London of the 21st century. That’s becoming a cultural reality because of the demographics. You have most of the world’s population in the region. You have most of the world’s economic and trade growth there as well.